The 10-Minute Rule for Hard Money Georgia

Wiki Article

Some Known Details About Hard Money Georgia

Table of ContentsSee This Report on Hard Money GeorgiaThe 10-Minute Rule for Hard Money GeorgiaFascination About Hard Money GeorgiaThe Single Strategy To Use For Hard Money GeorgiaThe Ultimate Guide To Hard Money GeorgiaHard Money Georgia Fundamentals Explained

Because hard money car loans are collateral based, also called asset-based financings, they call for very little documents and enable capitalists to close in a matter of days - hard money georgia. These lendings come with even more risk to the loan provider, as well as therefore require higher down payments and also have higher interest rates than a conventional lending.Many conventional financings may take one to two months to shut, however hard money car loans can be closed in a couple of days.

Standard mortgages, in comparison, have 15 or 30-year repayment terms on standard - hard money georgia. Hard money loans have high-interest prices. Many difficult money financing rate of interest rates are anywhere in between 9% to 15%, which is considerably greater than the interest price you can expect for a standard mortgage.

The Best Guide To Hard Money Georgia

This will certainly include buying an appraisal. You'll receive a term sheet that outlines the finance terms you have actually been accepted for. Once the term sheet is signed, the finance will certainly be sent to handling. Throughout financing processing, the lender will ask for documents and prepare the car loan for last car loan evaluation as well as routine the closing.

Excitement About Hard Money Georgia

Usual leave strategies consist of: Refinancing Sale of the possession Payment from various other source There are lots of scenarios where it may be beneficial to use a hard cash lending. For starters, investor who like to house turn that is, buy a review home in need of a whole lot of work, do the work directly or with contractors to make it extra important, then transform about and market it for a greater cost than they purchased for might locate difficult money fundings to be optimal funding alternatives.

Due to this, expert residence fins generally like temporary, busy financing options. In addition to that, residence fins normally attempt to market residences within much less than a year of acquiring them. Since of this, they don't need a long term and can stay clear of paying excessive rate of interest. If you purchase financial investment residential or commercial properties, such as rental residential or commercial properties, visite site you may click for more additionally locate difficult cash finances to be excellent options.

In some cases, you can additionally use a difficult cash funding to purchase vacant land. Note that, even in the above situations, the possible disadvantages of difficult cash lendings still use.

Hard Money Georgia Fundamentals Explained

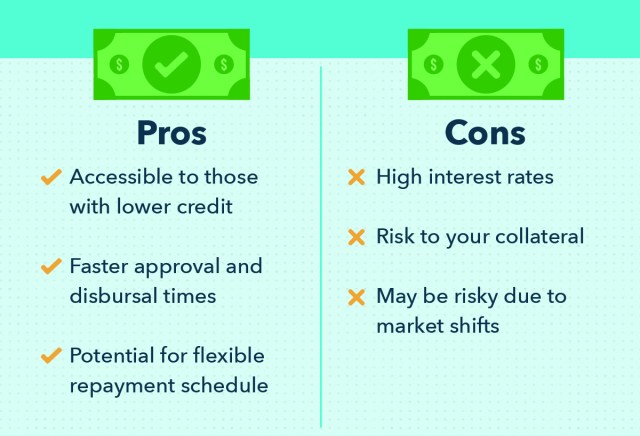

If the phrase "difficult cash" inspires you to begin quoting lines from your favorite gangster flick, we wouldn't be amazed. While these sorts of finances might sound difficult and intimidating, they are a generally used financing technique many actual estate capitalists make use of. Yet what are hard money finances, and also exactly how do they function? We'll describe all that and more below.Difficult money loans usually include higher rate of interest rates and also shorter repayment timetables. Why select a hard cash car loan over a standard one? To respond to that, we ought to first take into link consideration the benefits as well as disadvantages of difficult cash car loans. Like every financial device, tough cash financings included benefits and downsides.

For circumstances, a hard money lending might be a sensible alternative if you want a fixer-upper that might not get conventional funding. You can likewise use your present genuine estate holdings as security on a hard money car loan. Difficult money loan providers commonly reduce risk by billing higher rates of interest and providing much shorter settlement timetables.

The Ultimate Guide To Hard Money Georgia

Additionally, because personal people or non-institutional loan providers offer difficult cash fundings, they are not subject to the same laws as conventional lenders, that make them much more high-risk for customers. Whether a tough cash loan is right for you relies on your circumstance. Difficult money fundings are great choices if you were refuted a traditional car loan and also need non-traditional financing.Call the expert home mortgage consultants at Right Beginning Home Loan to find out more. Whether you wish to purchase or refinance your house, we're below to aid. Begin today! Ask for a free personalized rate quote.

The application procedure will typically involve an analysis of the property's value as well as possibility. This way, if you can not manage your settlements, the hard money lender will simply continue with marketing the home to redeem its investment. Difficult money lending institutions commonly charge higher interest prices than you 'd carry a conventional car loan, yet they additionally fund their lendings much more quickly and usually require much less paperwork.

Everything about Hard Money Georgia

Rather than having 15 to 30 years to pay back the lending, you'll generally have just one to five years. Tough cash car loans function rather differently than standard loans so it is necessary to comprehend their terms as well as what purchases they can be used for. Hard money finances are commonly meant for financial investment residential properties.Report this wiki page